Most companies also penalize cardholders after only one late payment by increasing the interest rate significantly. Almost half of households missed, or were late with a payment, resulting in late fees that average $39 each. Research shows that 47% of households have been called by a bill collector in the past year. How are we keeping up with all this debt? We are not! While this figure includes home mortgages and car loans, over $9,000 per family represents credit card debt. Lest that become a meaninglessly huge figure to skim over, that breaks down to $161,287 per man, woman and child-or $645,148 for a family of four. We do not encourage or condone the use of this program if it is in violation of these.

#DEBTINATOR SOFTWARE SOFTWARE#

Let us look at the current debt epidemic and what being debt free can mean for you…ĭebt is an Alarming Epidemic in Our Country.Īmerica is currently facing its highest debt black hole, in history with a total of $48 trillion. Laws concerning the use of this software vary from country to country. When you remove the emotion from it, it is really just focused effort and simple arithmetic.

#DEBTINATOR SOFTWARE MAC#

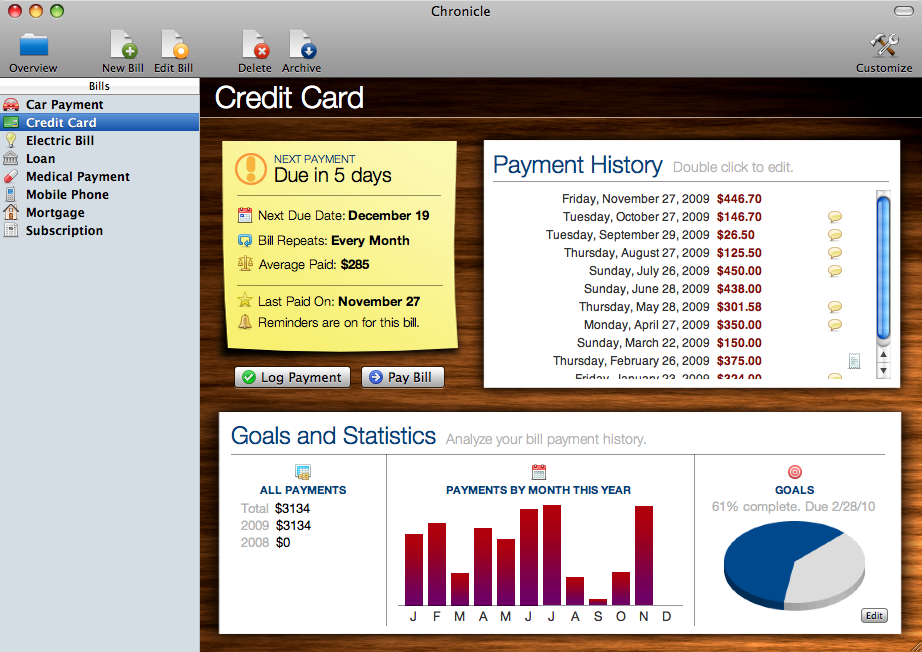

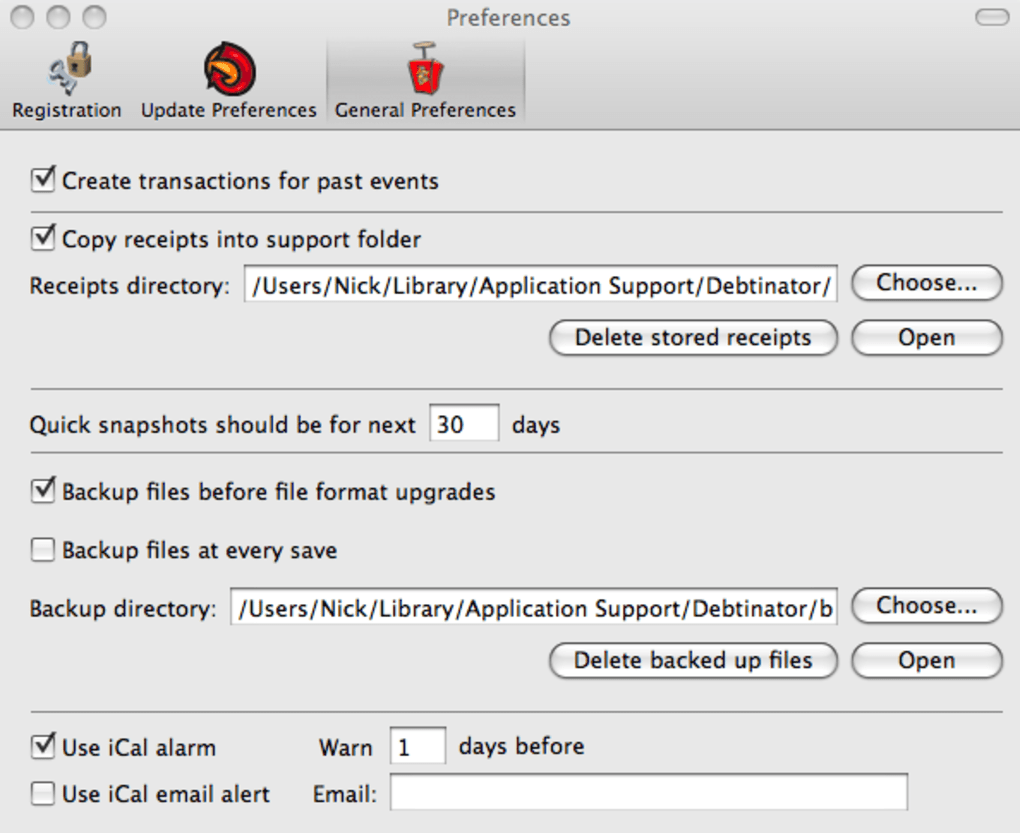

Mac software titles - commercial, freeware, and shareware. Getting out of debt need not be an overwhelming process. And then refer him to places like Version Tracker or MacUpdate that list. Then you can begin to build your financial freedom. Better tracking yields better results Debtinator watches every cent you have. It'll analyze your situation and come up with a plan that suits you best. You tell it where your money is coming from, and what you need to spend it on. Our goal for you (and hopefully your goal for you) is to be debt free now and in the future. Debtinator helps you keep track of everything you've done, but it also helps you plan for the future. From going to the store, to mowing the lawn, to taking the kids to school - money plays a part.įreeing yourself from debt is one of the first steps to taking control and improving how you handle money. At iMone圜oach we believe you can become debt free and successfully manage your money.Įverything we do is affected by money and how we handle money. Section 2: Defining Your Debtinator Marginĭebt is an alarming problem in our society.ĭebt is far too common in our country. Thank you for respecting the hard work of this author.įor more information, visit iMone圜 If you’re reading this book and did not purchase it, or it was not purchased for your use only, then please return to and purchase your own copy. If you would like to share this book with another person, please purchase an additional copy for each recipient. This ebook may not be re-sold or given away to other people. This ebook is licensed for your personal enjoyment only. The Debtinator ~ A Step-By-Step System to Eliminate your Debtĭiscover other iMone圜oach titles at Youve got a life to live! You have expenses. Think of the money youll save!īut realistically? So what. Everybody always tells you that you should get out of debt. Updated, interactive graphing engine - Updated the default debt line item payment order to reflect new government credit card regulations (higher interest rate balances paid first) - Minor modifications to color coding support - The ledger now does not expand accounts or debts with a single budget - Interest, charge, and cashback bonus transactions are now automatically assumed to clear - Fixed a bug that would constantly reset the backup duration to first open of weekĮverybody always tells you that you should get.

#DEBTINATOR SOFTWARE HOW TO#

And Debtinator tells you how to re-structure your money and pay them off as fast as possible. You tell it your debts, and everything about them. But if you happen to miss a few of those, well, whats the harm? Itll be paid off eventually, right? Debtinator handles all of the details for you. Sure, youll try and send the occasional $50 to your student loan on occasion, when you can. Think of the money youll save! But realistically? So what.

0 kommentar(er)

0 kommentar(er)